new

Payments

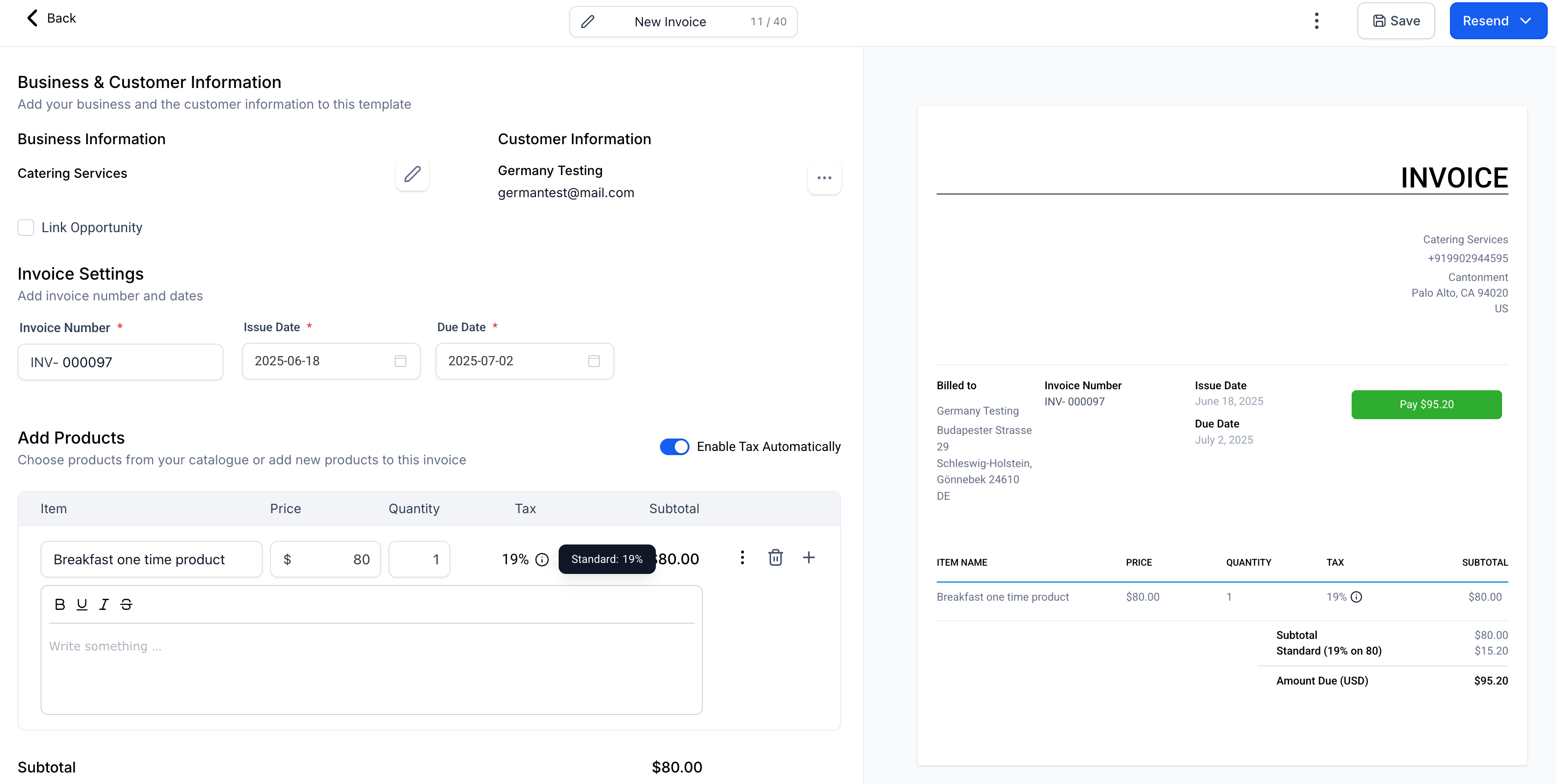

Invoicing

Funnels and Websites

E-Commerce Stores

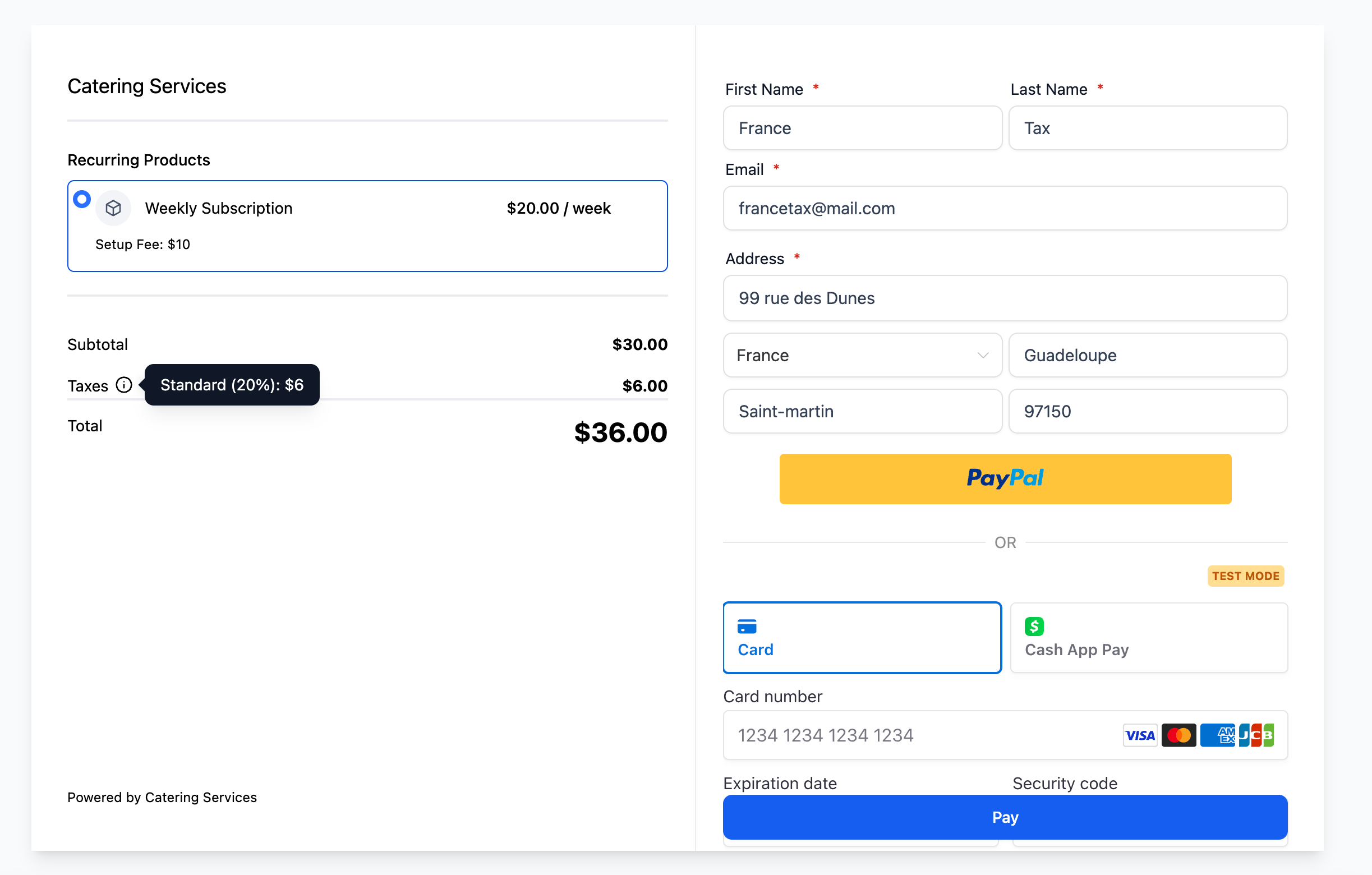

International Automatic Taxes (Includes VAT)

Business can now

configure and apply automatic taxes for multiple countries

including and outside the United States, ensuring accurate, compliant tax calculations across global checkouts.What's New?

- Businesses can select multiple countries for automatic tax calculation and also add country-specific VAT IDs or local tax ID numbers.

- Businesses can configure and manage nexus addresses to determine tax obligations in different geographies.

- Taxes are automatically applied on checkouts and invoice payments based on the customer’s address.

- Applicable across all checkout types — Funnels, Payment Links, Invoices, and Estimates, Ecommerce Stores— for all payment providers.

- Product-level configuration now supports global auto taxes.

- List of countries where automatic tax calculations would work is available in the list of Nexus Addresses.

- Any country where the business is required to collect taxes should be added to the list of nexus addresses. In case of US & Canada, respective states should be added wherever tax calculation is required.

- Adding countries/states can be done as a bulk action by selecting multiple countries/states in one go.

- Deleting countries/states need to be an individual activity but deleting a country with states separately added like Canada, will also delete the status from the list of Nexus address.

- A business can also plug in their Tax ID when adding a nexus address for a country- If there are additional tax benefits or applications based on the ID, it would be considered on the checkouts while calculating the taxes.

- This business Tax IDcan be edited from the list of configured nexus addresses.

For Existing US Automatic Tax users:

- A guided migration flow is made available in the same tax setting UI.

- Can Reconfigure the new global system via the UI.

- Will need to reconfigure nexus addresses and auto tax settings for all sub-accounts and products.

- Deprecation plan in place for the old US Auto Tax system in 6 months with clear warnings and fallback behavior.

What's Next?

- Capturing Business identification numbers or relevant tax IDs on all checkouts in case the end customer is a business to recalculate taxes based on the tax category, address as well as the business id.

- Enabling/Disabling automatic taxes on a product level.

- Cross border taxes (Custom Duty taxes) - In case a product is purchased and sold in different countries

Where can I configure automatic taxes

- Global tax setting - Payments > Settings > Taxes > Automatic Taxes

- Product level settings - Payments > Products > Edit/Create > Product Tax Code

Visuals